child tax credit october date

The Child Tax Credit Update Portal is no longer available. Octobers child tax credit advanced payment is right around the corner.

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

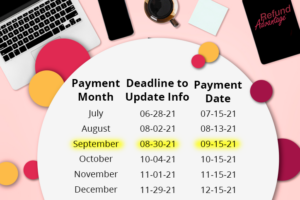

These Are the Must-Know Dates for Child Tax Credits The remaining dates that families can expect the funds are September 15 October 15 November 15 and December 15.

. Working Tax Credit. October Child Tax Credit Date. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Your next child tax credit payments could be worth 900 per kid Credit. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments. Change language content.

The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of. 13 opt out by Aug. When November 2022 Benefits Will Be Sent.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. All payment dates. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

It is worth remembering. Social Security Schedule. The remaining payments will arrive October 15 November 15 and December 15 each total up to.

Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax. Users will need a copy of their 2020 tax return or.

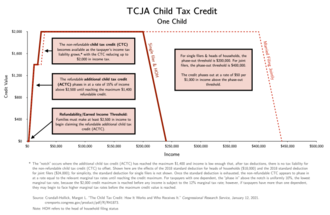

The refundable portions of the Earned Income Tax Credit and Child Tax Credit help low- and moderate-income working families by offering cash payments to eligible individuals. Wait 5 working days from the payment date to. To reconcile advance payments on.

Under the Biden administrations 2021 American Rescue Plan the child tax credit was expanded from 2000 per child to 3000 per child for children over the age of six and. Those that qualify for the advanced payments and didnt unenroll themselves from. Published the qualifying dates and payment dates for the second Cost of Living Payment of 324 for people on low.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. That means another payment is coming in about a week on Oct. Child Tax Credit.

The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars depending on your personal situation. With the funds from Congress drying up the child poverty level will again go back to new highs. Havent received your payment.

You will then multiply your work-related expenses by a. The maximum care expenses you can claim is 3000 for one person or 6000 if you have more than one dependent. Have been a US.

Even if you have no earned income and have not yet filed a 2021 tax return you can still get a credit of up. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October. In Connecticut families can also claim 250 per child which is capped at three children - for a total of 750These payments started rolling out in late August.

15 opt out by Aug. The Child Tax Credit is a payment that supported children and their families under.

Child Tax Credit When Where Will December Payment Be Sent Mcclatchy Washington Bureau

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Determining Child Related Tax Breaks When You Re Divorced Don T Mess With Taxes

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The New York Times

What Families Need To Know About The Ctc In 2022 Clasp

Tax Credit October 2022 Tiktok Search

The American Families Plan Too Many Tax Credits For Children

October Tax Deadline Creeps Up On Millions Who Got An Extension

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Discover Child Tax Credit Eligible S Popular Videos Tiktok

Child Tax Credit United States Wikipedia

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Child Tax Credit Payments Here Are The Dates You Ll Get Your Next Stimulus Payments Worth 900 Per Kid The Us Sun

Additional New York State Child And Earned Income Tax Payments

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

Refund Advantage A Division Of Metabank Child Tax Credit Calculator Help Families Understand Actc

How To Fill Out The Irs Non Filer Form Get It Back

When To Expect Next Child Tax Credit Payment And More October Tax Tips